Introduction

The global Fourth Party Logistics Market size is predicted to reach USD 102 billion by 2030 with a CAGR of 7.0% from 2025 to 2030. The Fourth Party Logistics (4PL) market is experiencing a dynamic transformation in 2025, driven by technological advancements, the e-commerce boom, and the need for integrated supply chain solutions. As businesses seek to optimize logistics operations, 4PL providers are stepping in as strategic partners, overseeing entire supply chains with data-driven insights and automation. Germany, a logistics hub in Europe, plays a pivotal role in this growth, supported by recent innovations and partnerships. This article explores the latest trends, key developments, and factors propelling the 4PL market forward in 2025, drawing on industry reports and emerging news.

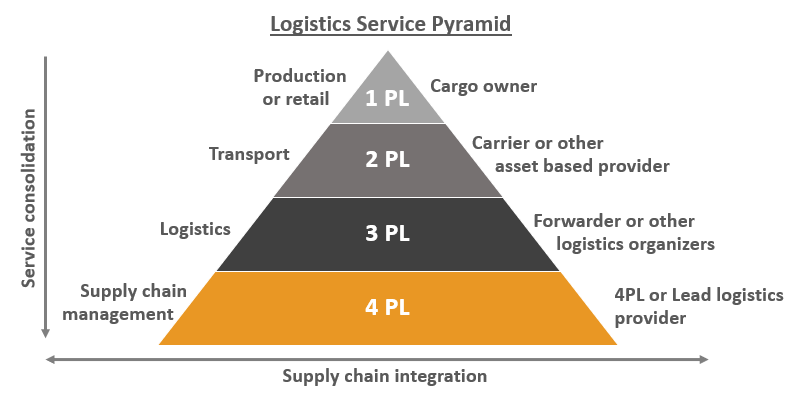

The Rise of 4PL in Logistics

Unlike traditional Third Party Logistics (3PL) providers, 4PL providers manage end-to-end supply chain operations, integrating multiple logistics functions, including transportation, warehousing, and inventory management. Europe, led by Germany, is a key region due to its advanced infrastructure and robust manufacturing sector.

The e-commerce surge, intensified by changing consumer behaviors, is a primary driver. With online retail demanding faster delivery and seamless operations, 4PL providers leverage technologies like artificial intelligence (AI), Internet of Things (IoT), and cloud-based platforms to enhance efficiency. In Germany, the adoption of 4PL solutions is accelerating as companies aim to streamline complex supply chains while reducing costs and environmental impact.

Recent Developments in 2025

In 2025, several notable developments are shaping the 4PL market. A significant milestone is the partnership between Samsung SDS and SAP, announced in early 2025, to integrate AI and hyper-automation into supply chain management. This collaboration focuses on real-time data analytics and robotic process automation, enabling 4PL providers to optimize logistics for clients in Germany and beyond. Such partnerships highlight the growing role of technology in 4PL operations.

Another key development is the increased adoption of cloud-based platforms like LEA Reply, implemented by Uniserve in its European operations. This platform enhances scalability and integrates 4PL services with warehouse robotics, improving order fulfillment and inventory accuracy. In Germany, where logistics efficiency is critical, such solutions are gaining traction among e-commerce and automotive sectors.

Germany’s Leadership in 4PL

Germany’s position as a logistics powerhouse makes it a focal point for 4PL growth. The country’s advanced infrastructure, coupled with its role as a gateway to European markets, drives demand for sophisticated logistics solutions. According to recent PMI data, Germany’s manufacturing sector saw a surge in new orders in June 2025, with the HCOB PMI reaching 49.0, reflecting strong demand for logistics services. 4PL providers are capitalizing on this by offering tailored solutions for industries like automotive, electronics, and retail.

Companies like DHL Supply Chain and DB Schenker, both headquartered in Germany, are leading the 4PL market. DHL’s 4PL services focus on end-to-end visibility, using AI-driven analytics to optimize supply chains. DB Schenker, meanwhile, emphasizes sustainability, integrating green logistics practices into its 4PL offerings, aligning with Germany’s environmental goals.

Technological Innovations

The integration of advanced technologies is a cornerstone of the 4PL market’s growth in 2025. AI and machine learning enable predictive analytics, helping 4PL providers anticipate demand fluctuations and optimize routing. IoT devices provide real-time tracking of goods, enhancing transparency and reducing delays. For instance, IoT-enabled sensors in warehouses allow 4PL providers to monitor inventory levels and streamline operations, a critical advantage in Germany’s high-throughput logistics hubs.

Blockchain technology is also gaining traction, offering secure and transparent transaction records. This is particularly relevant for Germany’s automotive sector, where complex supply chains require robust data management. Additionally, the use of digital twins—virtual replicas of supply chains—enables 4PL providers to simulate and optimize logistics processes, reducing costs and improving efficiency.

Market Segmentation and Applications

The 4PL market is segmented by type (synergy plus, solution integrator, industry innovator), end-user (e-commerce, automotive, healthcare, manufacturing), and region. The solution integrator model, which integrates multiple logistics functions, holds the largest market share in 2025, driven by its flexibility. E-commerce, with a 25.8% market share in 2024, remains the dominant end-user, followed by automotive and manufacturing, which rely on 4PL for supply chain optimization.

In Germany, the e-commerce sector’s growth, fueled by companies like Amazon and Zalando, drives demand for 4PL services. These providers manage complex logistics networks, ensuring seamless last-mile delivery. The automotive industry, a cornerstone of Germany’s economy, also relies on 4PL for just-in-time inventory management, reducing production delays.

Challenges and Opportunities

While the 4PL market is thriving, challenges remain. Labor shortages, a persistent issue in Germany, necessitate greater reliance on automation and 4PL services. However, concerns about job displacement due to automation, as noted in recent PMI data, highlight the need for workforce reskilling. Additionally, the high cost of implementing 4PL solutions can be a barrier for smaller companies, though cloud-based platforms are lowering entry barriers.

Opportunities abound in sustainability. Germany’s commitment to reducing carbon emissions aligns with 4PL providers’ focus on green logistics, such as optimizing transport routes to minimize fuel consumption. Partnerships with renewable energy providers and the adoption of electric vehicle fleets further enhance 4PL’s sustainability credentials.

Conclusion

The Fourth Party Logistics market in 2025 is poised for significant growth, driven by e-commerce, technological innovation, and Germany’s leadership in logistics. Partnerships like Samsung SDS and SAP, alongside platforms like LEA Reply, underscore the role of AI and automation in transforming supply chains. However, addressing labor concerns and ensuring inclusive adoption will be key to sustaining this growth, cementing 4PL’s role in redefining logistics.

Write a comment ...