Introduction

The Denmark Warehouse Robotics Market size is predicted to reach USD 47.9 million by 2030, at a CAGR of 14.2 % from 2025 to 2030. Denmark, a Nordic leader in innovation and sustainability, is making significant strides in the warehouse robotics market in 2025. Fueled by the global e-commerce boom, technological advancements, and a strong focus on efficient logistics, Danish warehouses are increasingly adopting robotic solutions. While Denmark-specific news is limited, global trends and the country’s robust logistics infrastructure provide insight into its market dynamics. This article explores recent developments, key drivers, and Denmark’s role in the warehouse robotics market, drawing on industry reports and regional context.

E-Commerce Surge as a Catalyst

Denmark’s growing e-commerce sector, driven by platforms like Zalando and local retailers, contributes to this growth. In 2024, e-commerce accounted for 25.8% of the global market share, and Denmark’s high internet penetration and consumer preference for online shopping amplify demand for robotic solutions in warehouses.

Autonomous mobile robots (AMRs), expected to hold over 29% of the market share in 2025, are critical for Denmark’s logistics sector. These robots streamline tasks like picking and material transport, addressing the need for speed and accuracy in urban hubs like Copenhagen and Aarhus.

Recent Developments

While specific deployments in Denmark are less documented, global trends are influencing the Nordic region. The partnership between Uniserve and Logistics Reply to implement LEA Reply, a cloud-native warehouse management system (WMS), is transforming European logistics, including Denmark. This platform integrates AMRs with AI-driven analytics, enhancing scalability and efficiency in e-commerce warehouses.

Amazon’s milestone of deploying over 1 million robots globally, powered by its “DeepFleet” AI model, also impacts Denmark, where Amazon operates fulfillment centers. This AI model reduces robot travel time by 10%, improving delivery speeds. Danish logistics firms are likely adopting similar technologies to compete in the fast-paced e-commerce market.

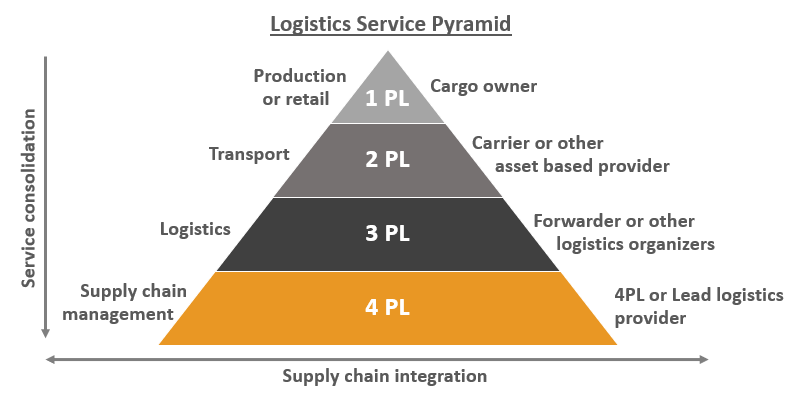

Key Players and Market Dynamics

Denmark’s warehouse robotics market is shaped by global players like ABB Ltd., FANUC Corporation, and Daifuku, alongside regional innovators. Local companies, such as MiR (Mobile Industrial Robots), a Danish firm specializing in AMRs, are leading the charge. MiR’s robots, designed for flexible navigation, are widely used in European warehouses, including Denmark’s logistics hubs.

The market is segmented by product type (AMRs, AGVs, robotic arms), function (picking and placing, packaging, storage), and end-user (e-commerce, automotive, food and beverage). The picking and placing segment dominates with over 34% market share in 2025, driven by e-commerce needs. Automated storage and retrieval systems (ASRS), growing at a 10.5% CAGR, optimize space in Denmark’s compact warehouses, particularly in urban areas.

Technological Advancements

Denmark’s reputation for technological innovation supports its warehouse robotics market. AI and machine learning, as seen in Amazon’s Sparrow robot, enable precise handling of diverse stock-keeping units (SKUs). In Denmark, similar AI-driven systems are being adopted to manage complex inventories. IoT-enabled sensors provide real-time data on inventory and robot performance, enhancing supply chain visibility.

Economic and Policy Support

Denmark’s strong economy and supportive policies drive robotics adoption. The country’s logistics sector benefits from its strategic position as a gateway to Scandinavia and Europe. Recent PMI data reflects robust manufacturing demand in Europe, supporting Denmark’s warehouse robotics growth.

Denmark’s commitment to sustainability aligns with robotics’ ability to reduce energy consumption and waste. Green logistics initiatives, such as optimized transport routes and energy-efficient robots, support the country’s climate goals. However, labor shortages, a global challenge, are acute in Denmark’s small population, necessitating automation but raising concerns about job displacement.

Denmark’s Role in Europe

Europe holds a significant share of the global warehouse robotics market, with Denmark contributing through its innovation ecosystem. While Germany and the UK lead in scale, Denmark’s focus on sustainable and AI-driven solutions positions it as a niche leader. Partnerships like Samsung SDS and SAP’s collaboration on AI and hyper-automation influence Nordic logistics, enhancing Denmark’s warehouse efficiency.

Challenges and Opportunities

High implementation costs are a barrier for smaller Danish firms, though cloud-based solutions are reducing entry barriers. Workforce displacement concerns require reskilling programs, leveraging Denmark’s strong education system. Opportunities lie in sustainability, with robotics enabling greener logistics, and in customized solutions for Denmark’s SME-dominated market.

Conclusion

Denmark is shaping the warehouse robotics market in 2025 through its embrace of e-commerce, AI, and sustainability. Global trends like LEA Reply and local innovations from firms like MiR highlight its potential. Addressing cost and labor challenges through inclusive policies will sustain this growth, positioning Denmark as a Nordic leader in warehouse robotics.

Write a comment ...